Professional Services

The Dynamic-GRC team are experts across financial services:

♦ Identify/Assess AML Requirements/Risk

♦ Plan, Resource and Implement AML Strategy

♦ AML Monitoring, Reporting and Record Keeping

♦ KYC/Transaction Investigations/Case Management

Consulting

With experience across a wide range of GRC areas, our consultants are able to advise on:

- Current and best market practices

- Optimising current resources

- Use of technology to improve quality/efficiency

- International GRC developments/requirements

Working with front/mid/back office personnel our consultants focus on practical solutions that are achievable.

Regulatory Technology

We believe using RegTech is the only way for firms to:

- Improve the quality of internal processes/controls

- Minimise key person dependency

- Maintain management oversight

- Capture and store the required records

Our consultants are experts implementing and optimising RegTech solutions, including our own GRC-Maestro platform, so firms get the most out of technology.

GRC Assurance

Dynamic-GRC offers a range of GRC Assurance based on our proprietary methodology which has been developed working with a wide range of regulated financial services firms.

As experts in GRC, we don’t just list your challenges, we also advise on your solutions.

Professional Staffing

Our Governance, Risk & Compliance professionals are able to assist firms with their short-term and long-term staffing requirements:

- Special projects

- Interim staffing

- Technology implementations

Governance, Risk & Compliance: Delivered by Experts

International Expertise & Coverage

Dynamic-GRC work with work with a network of local specialist compliance consultants who can advise on the intricacies and nuances of their jurisdiction.

Our Partners give is the ability to support clients with projects in one or more jurisdictions in parallel with the best local expertise and in a cost-efficient manner.

Project Management

Each Dynamic-GRC project has an appointed Responsible Manager who acts as an expert resource and communication point.

The Dynamic-GRC managers have at least 10 years technology and/or legal/compliance experience working with major financial firms in the global financial centres.

GRC Thought Leadership

Our Professional Services team are recognised as thought leaders in Governance, Risk & Compliance.

Regularly publishing ground breaking papers on GRC, we stimulate debate and help promote the evolution of GRC as a recognised profession.

Individual Excellence

Our Dynamic-GRC consultants are selected based on their industry experience, professional expertise and knowledge of technology and data.

Having worked a minimum of 10 years on software projects and in compliance/legal roles with major firms, Dynamic-GRC consultants uniquely qualified.

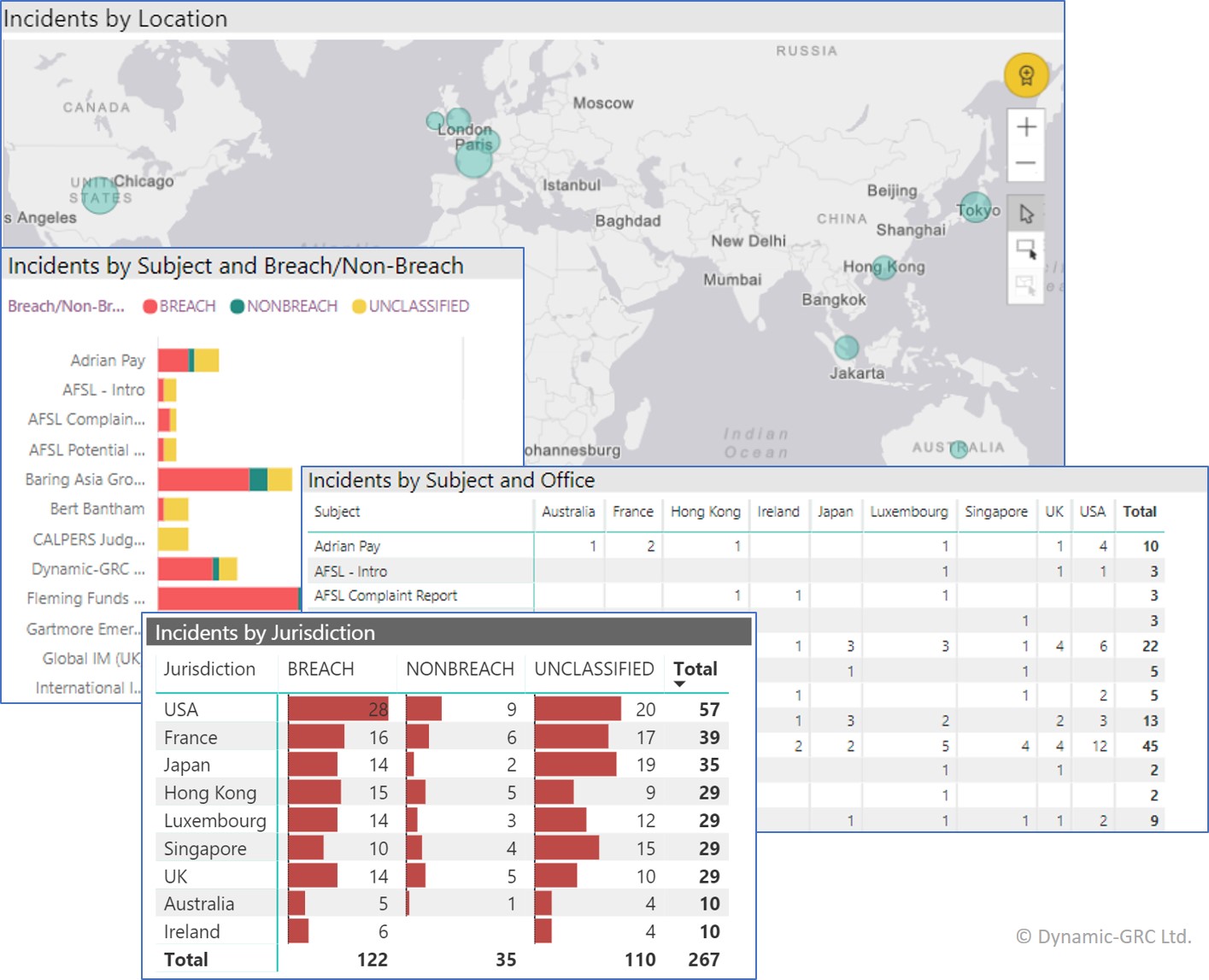

GRC BUSINESS INTELLIGENCE (BI)

Our proprietary “GRC BI Program” gives Senior Management detailed analysis of their GRC environment*, with optional analysis by:

♦ Legal Entity

GRC issues by legal entity (regulated and non-regulated) and consolidated at group/operating level.

♦ Regulatory Jurisdiction

GRC issues consolidated by regulator and/or jurisdiction.

♦ Laws/regulations

GRC issues consolidated by individual law/regulation.

♦ Contract

GRC issues regarding contracts entered with clients or vendors consolidated by contract/contracting party.

* Dependent on data availability